AI Servers Trigger a Structural Surge in Global MLCC Demand

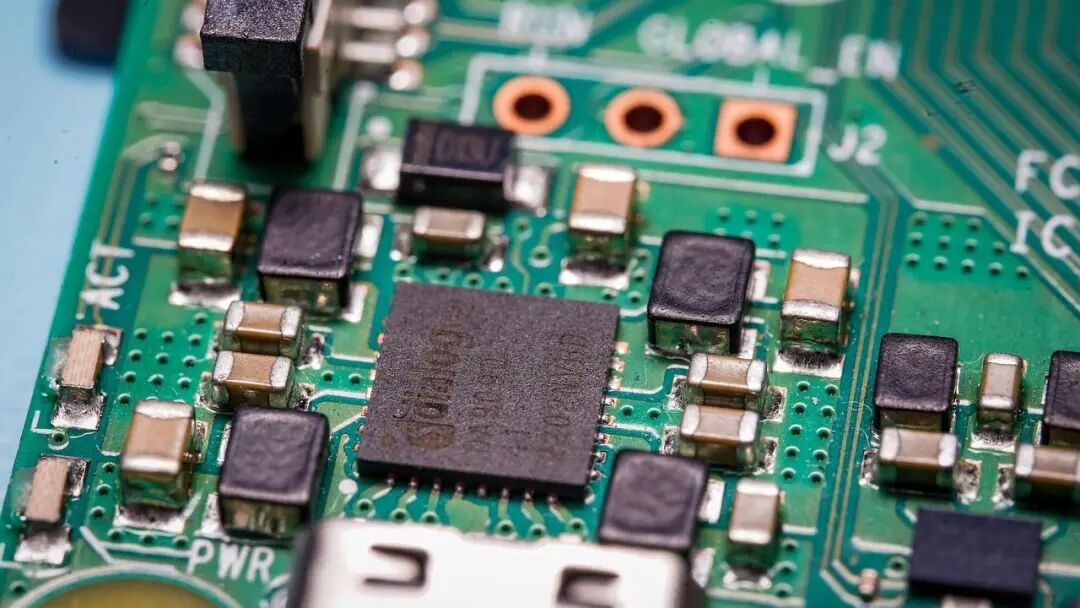

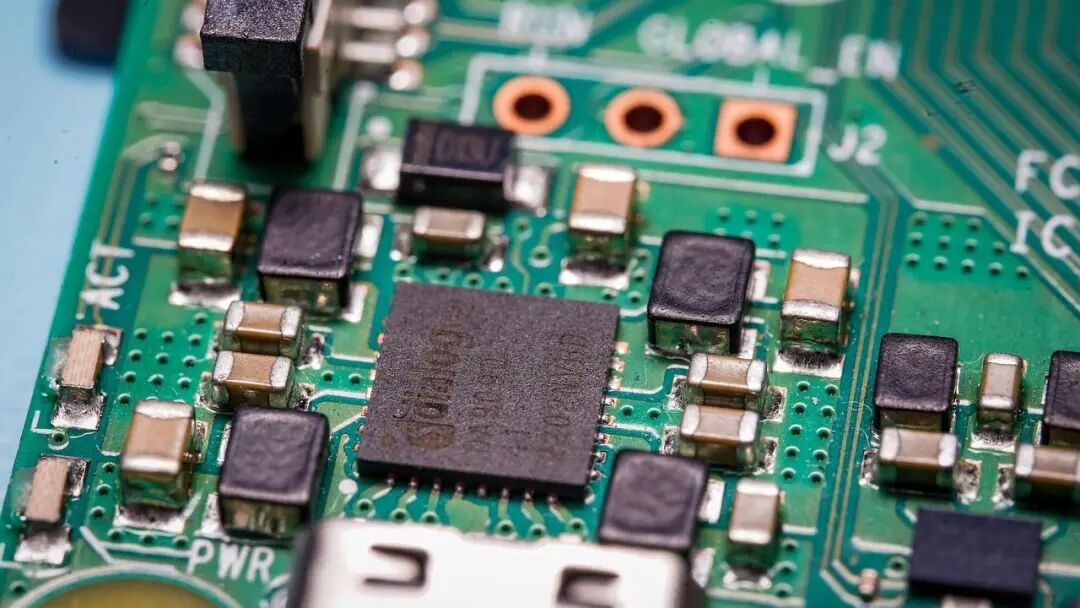

The global passive components industry is entering a new growth cycle driven by the rapid acceleration of AI infrastructure construction. As MLCCs (Multilayer Ceramic Capacitors) serve as the “capillaries” of electronic systems, demand from AI servers is expanding at an unprecedented rate. A single AI server equipped with NVIDIA’s latest GB300 platform requires approximately 30,000 MLCCs—thirty times that of a smartphone and nearly three times more than an internal combustion vehicle. A complete AI server rack consumes up to 440,000 MLCCs, representing a new magnitude of demand compared with previous cycles such as cryptocurrency mining machines.

AI Servers Become the Strongest Growth Engine for MLCC

Murata projects that MLCC demand from AI servers will grow at a 30% CAGR, with the 2030 requirement reaching 3.3× that of 2025. The demand surge stems from the unique power characteristics of high-performance ICs used in AI compute systems. During high-load operations, these processors generate instantaneous current fluctuations. MLCCs stabilize voltage, suppress noise, and compensate for transient current dips, making them indispensable to stable AI compute performance.

The rapid upgrade of AI server power systems further amplifies demand. As power modules evolve from 10 kW to 15 kW, MLCC usage has increased from roughly 2,200 units in traditional power systems to 20,000+ units today, with next-generation platforms expected to exceed 30,000 units per power system.

Market Structure: Asia Leads with Layered Competition

The MLCC market is dominated by Japanese, Korean, Taiwanese, and Mainland Chinese manufacturers. Global MLCC market size reached USD 39.1 billion in 2024, with China contributing 44% of global demand.

* Japan leads with deep strengths in materials science, ceramic formulation, and process control.

* Murata holds 28.6% global market share and maintains technological leadership in AI server and automotive-grade applications.

* China and Hong Kong together contribute 55% of Murata's FY2024 revenue.

* China’s manufacturers are accelerating localization.

Since 2020, China’s MLCC domestic substitution rate has risen from 12% to 22%.

* Fenghua Advanced Tech reported strong growth in automotive and communications sectors.

* Sunlord Electronics became a supplier of inductors for NVIDIA’s AI servers, with related revenue increasing 73%.

* Taiwan and Korea maintain critical positions in high-end MLCC and inductive components, with companies such as Yageo and Samsung Electro-Mechanics actively expanding AI-related capacity.

Industry Reactions: Revenue Growth and Structural Price Increases

Strong downstream demand is reshaping business performance across the supply chain.

* Taiwan’s Yageo reported NT$12.265 billion in November revenue, a historical monthly record, driven by high-end and AI-related products.

* Yageo has also initiated selective price increases, especially for tantalum capacitors.

Market data indicates:

* Automotive-grade MLCC prices increased 8–12% YoY in 2024

* High-power inductors for AI servers increased 10–15%

* Consumer-grade products decreased 3–5% due to oversupply

This divergence marks a clear “dual-speed” market—premium components benefit from structural demand, while commodity products face pressure.

A New Growth Cycle Is Emerging

As AI infrastructure expands globally, leading manufacturers are raising their growth expectations. Murata increased its FY2025 revenue target from 1.64 trillion to 1.74 trillion yen. Taiwanese distributor Nichidenbo noted that MLCC has risen to the third-highest cost item in AI server BOMs, only behind GPUs and memory. Accelerated deployment of Google’s TPU—expected to reach 3.3 million units in 2026, up 1 million units—will further intensify MLCC consumption.

Future competition in the MLCC sector will center on three pillars:

Materials innovation

High-performance and miniaturization technologies

Global supply chain reconfiguration

Manufacturers that secure strategic partnerships with leading AI server and EV customers will gain a decisive competitive edge.

Major suppliers are already moving:

* Samsung Electro-Mechanics plans to expand MLCC capacity for AI servers beginning next year.

* Yageo continues to scale through acquisitions, broadening its portfolio to include wireless components, sensors, and circuit protection devices.

Conclusion

The global passive component industry is entering a structural and multi-year growth phase. Beyond the persistent upward trend in memory prices, MLCCs are now emerging as the next major driver of the electronics supply chain. With AI servers entering mass deployment worldwide, MLCC demand is set to escalate, signaling the arrival of a new industry cycle.

MCU Solutions

MCU Solutions PCBA Solutions

PCBA Solutions Bluetooth Solutions

Bluetooth Solutions

FAQ

FAQ Contact Us

Contact Us

Company News

Company News Technology News

Technology News Industry News

Industry News PCBA News

PCBA News

Company Profile

Company Profile Certificates

Certificates Terms & Conditions

Terms & Conditions Privacy Statement

Privacy Statement

Home Appliances

Home Appliances Beauty Appliances

Beauty Appliances Lighting

Lighting Kid's Toys

Kid's Toys Security Alarm

Security Alarm Health Care

Health Care

More information?

More information?